The Lowdown on Reverse Mortgage Loans...

Our Reverse Mortgage Rates Are Low & Our Process is Quick & Painless

A reverse mortgage is a loan for seniors age 55 and older. HECM/HOMESAFE reverse mortgage loans are insured by the Federal Housing Administration (FHA) and allow homeowners to convert their home equity into cash with no monthly mortgage payments.

We’re here to make the reverse mortgage process a whole lot easier, with tools and expertise that will help guide you along the way, starting with our FREE Reverse Mortgage Qualifier.

We’ll help you clearly see differences between reverse mortgage options, allowing you to choose the right one for you.

The Reverse Mortgage Process

Here’s how our reverse mortgage process works:

- Complete our simple Reverse Mortgage Qualifier

- Receive options based on your unique criteria and scenario

- Compare mortgage interest rates and terms

- Choose the offer that best fits your needs

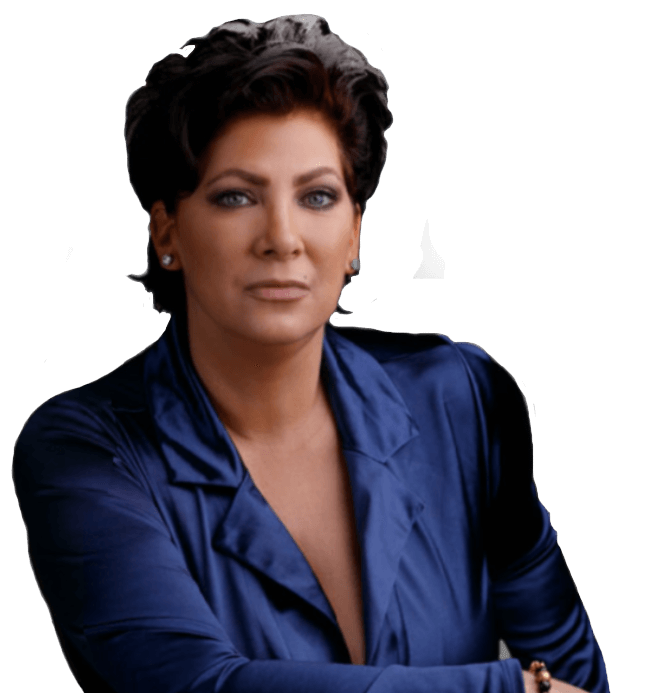

I grew up in a household of three generations. I’ve always revered my elders and was grateful for their wisdom and experiences they imparted unto me.

Prior to having my daughters, my way of giving back to my community, was volunteering my comfort and talent as an art docent in senior living settings. Than in the 2008 housing crash, like most, I lost everything, my construction companies, car dealership, along with my marriage. And whatever was left of the wealth we built, the attorneys saw fit to take that and then some.

Faced with insurmountable debt and the threat of losing my triple 2 year daughters, I reinvented myself. I thought the next time around I will be well prepared and knowledgeable, and what better career to choose for myself to stay ahead of the curve, but banking?

In the meantime I had to get a JOB…

Not only was I going to prepare for the next housing correction, but what I went through was not going to be in vain. I share my story, coach and guide others, so what I went through wouldn’t be for naught. As a result, I started studying to become a mortgage broker, and to pay the bills, I worked both day and grave shifts as a personal caregiver and activity director for dementia clients.

I have witnessed and experienced the financial challenges of my care giving clients, whom over the years have become my extended family. So it was important for me to become a solution, and so I also became Certified in Reverse Mortgages.

Since then I have gone onto facilitating my borrowers and their families by

- Financing an eldercare plan

- Age in place

- Pay off liens

- Amicably navigate a win-win Grey Divorce with a Reverse and Reverse for purchase

- Get ahead of the rising cost of inflation on a fixed income

- Augment their investment portfolios

- Endow a much needed living inheritance

- Deferred their Social Security for a greater return

While never having another mortgage payment ever again!

Let’s face it, Equity is not a savings, its lazy money, and the amount available to you is contingent on the Jones’s paying their bills and other market factors.

The only conventional way to gain access to your hard earned equity is to

1-SELL-this option leaves you searching for another home, leaving you with capital gains.

or

2-Do a cash out refinance-this option leaves you at square one and higher monthly payments

I am not only passionate about helping our senior community flourish, but it’s my honor and pleasure to give back to a generation that helped mold me.

Let me help you preserve the dignity and freedom you worked hard for and so deserve….

Julia

Why a Reverse mortgage?

A reverse mortgage pays off your existing mortgage, should you have one, by allowing you access to the home equity you’ve worked so hard to build. Any money left after paying off your existing mortgage is available to use as you see fit.

- Full or Partial Lump Sum

- Line of Credit

- Monthly Payments

- Combination of Any of These

You have the option to change your disbursement method at any time.